Forex Trading: A Beginner’s Comprehensive Guide

If you’re interested in making a profit through currency trading, you’ve come to the right place. In this guide, you will learn the basic principles of forex trading, practical tips for getting started, and valuable strategies to enhance your trading experience with the best resources available, including the forex trading beginner guide Trading App APK.

What is Forex Trading?

Forex, or foreign exchange, refers to the global marketplace for buying and selling national currencies against one another. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Traders can profit from even minor fluctuations in currency values, making it an attractive option for those looking to invest. Understanding the fundamental concepts of forex trading is crucial for success in this competitive arena.

Key Terms in Forex Trading

- Currency Pair: Currencies are traded in pairs, such as EUR/USD (Euro to US Dollar) or GBP/JPY (British Pound to Japanese Yen).

- Bid Price: The price at which a trader can sell a currency pair.

- Ask Price: The price at which a trader can buy a currency pair.

- Spread: The difference between the bid and ask price, which is a cost to the trader.

- Leverage: A mechanism that allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases losses.

- Lot: A standard unit of measurement for a position size in forex trading. A standard lot is typically 100,000 units of the base currency.

Getting Started with Forex Trading

To begin your journey in forex trading, you’ll need to take several essential steps:

1. Choose a Reliable Broker

Your choice of broker is crucial since it will influence your trading experience. Look for a broker that is regulated, offers a user-friendly trading platform, has competitive spreads, and provides various trading resources. Check for a demo account feature, which allows you to practice without risking real money.

2. Open a Trading Account

Once you’ve selected a broker, you will need to open a trading account. Brokers usually offer different types of accounts—standard, mini, and micro accounts. Choose the one that suits your trading style and risk tolerance.

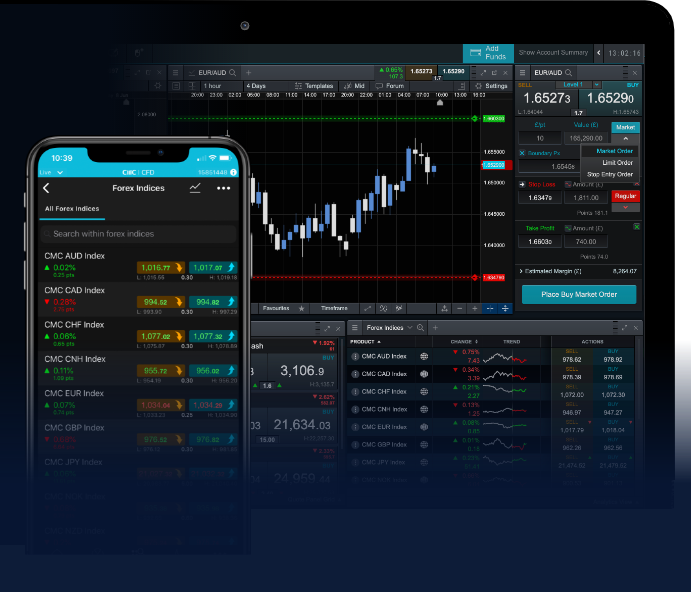

3. Familiarize Yourself with Trading Platforms

Trading platforms are where the trading action takes place. Learn to navigate your broker’s platform effectively, understanding how to place trades, set stop-loss orders, and use technical indicators.

4. Develop a Trading Plan

A trading plan outlines your trading goals, risk management strategies, and the criteria for entering and exiting trades. Stick to your plan to avoid impulse decisions based on emotions.

Key Strategies for Forex Success

While there is no one-size-fits-all strategy in forex trading, there are some commonly used approaches that can help you succeed:

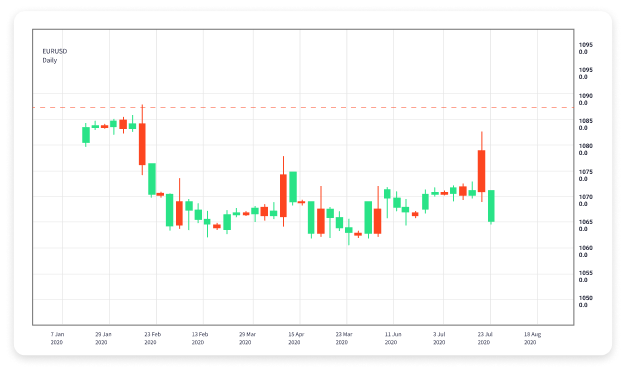

1. Technical Analysis

This involves analyzing price charts and patterns to forecast future price movements. Traders use various tools and indicators, such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements, to identify trends and entry points.

2. Fundamental Analysis

Understanding national economic indicators, geopolitical events, and monetary policy can provide valuable context for currency movements. Pay attention to news releases related to economic growth, employment rates, inflation, and interest rates, as these can significantly impact currency values.

3. Risk Management

Effective risk management is vital for long-term success in forex trading. Never risk more than a small percentage of your trading capital on a single trade. Use stop-loss orders to protect your investments and ensure that your winning trades outweigh your losing trades.

4. Keep Learning

The forex market is constantly evolving, and staying updated with the latest trends, strategies, and market conditions is essential. Consider joining trading communities, participating in forums, or investing in courses to expand your knowledge.

Common Mistakes to Avoid in Forex Trading

As a beginner, it’s easy to make mistakes when entering the forex market. Here are some common pitfalls to watch out for:

- Overtrading: Trading too frequently can lead to higher transaction costs and emotional turbulence. Focus on quality trades rather than quantity.

- Chasing Losses: Trying to recover losses by making impulsive trades can lead to even bigger losses. Maintain a level-headed approach and stick to your trading plan.

- Lack of Discipline: Failing to follow your trading plan or allowing emotions to dictate decisions can be detrimental to your trading results. Practice self-discipline and stick to your strategy.

- Neglecting a Trading Journal: Keeping a journal of your trades, including entries, exits, and trade performance, can help you identify patterns and improve your trading skills.

Conclusion

Starting your journey in forex trading can be both exciting and daunting. However, with the right knowledge, a solid plan, and disciplined execution, you can navigate the complexities of the forex market and work toward achieving your financial goals. Remember to equip yourself with learning resources, market insights, and a reliable trading app to stay informed and efficient in your trading endeavors.

7 thoughts on “Forex Trading A Beginner’s Comprehensive Guide”

https://t.me/s/site_official_1win/247

https://t.me/officials_pokerdom/3369

https://t.me/s/iGaming_live/4866

Hi there! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up losing many months of hard work due to no backup.

Do you have any methods to prevent hackers?

Hello to all, the contents present at this website are in fact amazing for

people knowledge, well, keep up the nice work fellows.

https://t.me/s/iGaming_live/4876

В мире ставок, где любой ресурс норовит привлечь обещаниями быстрых джекпотов, рейтинг казино игровые автоматы бесплатно

является как раз той картой, что направляет сквозь дебри подвохов. Игрокам профи плюс новичков, кто устал с фальшивых посулов, такой средство, дабы ощутить настоящую отдачу, словно вес ценной фишки на пальцах. Обходя ненужной болтовни, просто реальные клубы, там rtp не только показатель, а реальная фортуна.Составлено по поисковых поисков, словно сеть, что захватывает наиболее актуальные тренды на рунете. Здесь минуя пространства к шаблонных трюков, любой пункт как карта на покере, в котором подвох раскрывается сразу. Игроки видят: на стране стиль письма с сарказмом, там сарказм скрывается под рекомендацию, даёт миновать ловушек.В https://kasinos-don8play.webflow.io/ такой список ждёт как открытая карта, подготовленный на старту. Загляни, коли нужно ощутить биение реальной ставки, без иллюзий да неудач. Для кто знает тактильность приза, это словно держать ставку на ладонях, вместо смотреть в монитор.